Bitcoin is a ‘store of value’ and why it is compared to ‘digital gold.’

A store of value is any commodity or asset that normally retains purchasing power into...

A store of value is any commodity or asset that normally retains purchasing power into the future and is the function of the asset that can be saved, retrieved, and exchanged at a later time and be predictably useful when retrieved. The purpose of any store of value is to manage risk by ensuring a consistent demand for the underlying asset. Money, currency, or a commodity such as a precious metal or financial capital have been the most common stores of value in modern times. Money is one of the best stores of value due to its liquidity, or the ease with which it can be exchanged for other goods and services. The total of all stores of value, including both monetary and nonmonetary assets, constitutes an individual’s wealth.

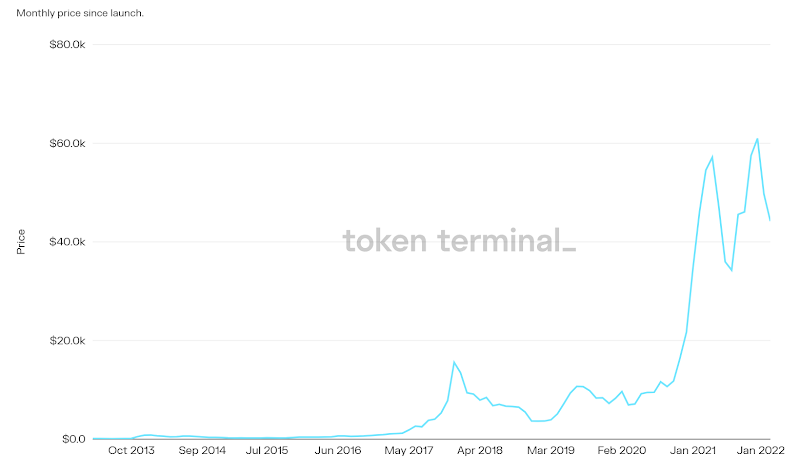

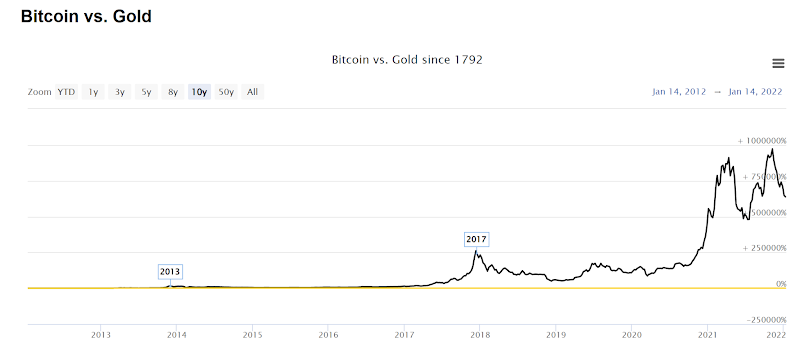

Traditionally, as an investor, you would hold a portion of your portfolio in precious metals such as gold. This protects against the losses that stocks can sustain during a downturn in the economy. This has proven to be effective and continues to be so—but a new alternative is posing a threat to this time-honored method of capital preservation. Bitcoin is proving to be an intriguing asset for investors because it has been around long enough to gain recognition and support—it is even exhibiting some trends.

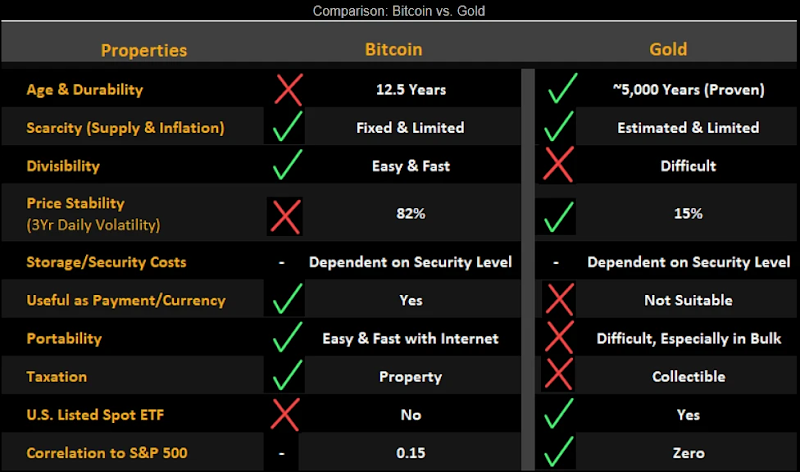

Satoshi Nakamoto, whose true identity is unknown, founded Bitcoin in 2009. According to Satoshi’s Whitepaper, Bitcoin will be the first purely peer-to-peer electronic cash system that does not rely on any financial intermediary. Bitcoin, like gold, has a finite supply. There is a limit of 21 million tokens programmed into the source code, as well as halving events, which reduce the supply of Bitcoin by 50%, ensuring that the final Bitcoin will not be issued until around the year 2140. Through an innovative incentive structure, so-called “miners” compete to solve a math problem and are rewarded in Bitcoin, thereby securing the network and verifying transactions. Both gold and bitcoin are frequently regarded as a means of diversifying a portfolio as well as a hedge against inflation and fiat currency depreciation.

Gold has historically performed well during market corrections because it maintains its value; its price holds somewhat steady, then tends to rise as investors shift away from stocks and toward gold if a recession is imminent. As a result, it can be used as a hedge—an investment that moves in the opposite direction of another—against market corrections or recessions. For thousands of years, gold has dominated economies and markets as a means of exchange and wealth storage. Bitcoin was launched in 2009, but it did not gain widespread acceptance until several years later.

Some argue that Bitcoin has no intrinsic value because it is not backed by gold (a commodity with no intrinsic value) or by a redemption guarantee. However, guess what? The US dollar does not have a redemption guarantee. Politicians in control of the printing press are transitory and lack fiscal prudence. They are constantly raising their own debt ceiling in order to fund projects and infrastructure for which they are unwilling to tax their citizens.

Every other government, as well as every state, municipality, business, non-governmental organization, and household, must balance their budgets. Every dollar spent must be accompanied by a dollar earned. If a person or business becomes indebted, they must find lenders who qualify them and truly believe in their ability to repay. However, this is not the case in the United States. Because the dollar is the world’s reserve currency, it has been treated as a non-inflatable asset with a fixed value set by God. Is it, however, true?

According to the US government, the dollar is backed by “the good faith and credit of the American worker.” That appears to be a meaningful statement—but here’s the catch: The United States has a massive trade deficit. Bitcoin on the other hand is a capped commodity that is determined solely by supply and demand. (This is the same mechanism that drives the price of gold and dollars, but in the case of Bitcoin, the supply is well known and the mechanism cannot be gamed.) Bitcoin replaces trust in a fleeting government with trust in an immutable, transparent, and auditable mechanism. No one needs to rely on a centralized authority or on one another. Instead, we all put our faith in a mathematical process.

During the Covid-19 pandemic, not all investors turned to Bitcoin; many opted for more traditional strategies, such as gold. As a result, the price of gold has risen from just under $1,300 in late 2019 to nearly $2,100 in mid-2020. Its price fell through 2021 as economies gradually recovered, but it remained higher than pre-pandemic recession levels.

The gold industry’s established system for trading, weighing, and tracking is flawless. It is extremely difficult to steal or forge, and it is also highly regulated. Many countries prohibit crossing borders with gold unless you have regulatory permission. When it comes to gold investing, you should generally only buy it from registered dealers and brokers; one caveat is that you should only buy physical gold if you can safely store it.

Because of its encrypted and decentralized system, Bitcoin is also difficult to steal and forge. With a few exceptions, it is generally legal to use across national borders. However, the regulatory infrastructure that could exist to ensure user safety is not yet in place; additionally, the anonymity of cryptocurrency makes it difficult to regulate.

Bitcoin has historically been influenced by the media, investor sentiment, regulatory actions, and hype. News from the digital currency world may cause investors to panic and make hasty decisions, sending Bitcoin’s price rapidly upward or downward. Because of the reasons stated above, gold does not have this volatility, making it a potentially safer asset.

Rather than viewing Bitcoin and gold as diametrically opposed assets, we believe they can complement each other in a portfolio. In some cases, gold is superior to Bitcoin, while in others, Bitcoin is superior to gold. Bitcoin is more transportable, divisible, and useful as a currency. However, gold is more stable and has a proven track record. Both have almost no correlation to traditional asset classes, with gold having a correlation of 0. Nonetheless, Bitcoin is best described as a speculative asset at the moment.

For these reasons, and because Bitcoin has the potential to become a store of value in the future, many institutions and investors are converting at least a portion of their gold positions to Bitcoin as a hedge and diversifier.

References

Get product updates, insights, market analysis, and recaps delivered straight to your inbox.

Our latest news, insights, and analysis.

A store of value is any commodity or asset that normally retains purchasing power into...

Join a growing community of traders focused on learning, growing, and living a life of financial freedom.

Sign up for our weekly newsletter. Get market insights, trade topics, and weekly recaps straight to your inbox!

© 2023 · Cryptolifer.com · All Rights Reserved.

The Site cannot and does not contain financial advice. The education information is provided for general

informational and educational purposes only and is not a substitute for professional advice. Accordingly,

before taking any actions based upon such information, we encourage you to consult with the appropriate

professionals. We do not provide any kind of financial advice. THE USE OR RELIANCE OF ANY

INFORMATION CONTAINED ON THE SITE IS SOLELY AT YOUR OWN RISK. For more information please read our disclaimer.

Stay up to date on all things Cryptolifer. Join our weekly newsletter to get mentorship, exclusive sector insights, and trading education. Take advantage of this free resource!